Page 156 - MSM_AR2020

P. 156

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

3 SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(i) Property, plant and equipment (continued)

See significant accounting policies Note 3(g) on borrowing costs. To the extent a legal or constructive obligation to a third

party exists, the acquisition cost includes estimated cost of dismantling and removing the assets are restoring the site.

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate,

only when it is probable that future economic benefits associated with the item will flow to the Group and the cost

of the item can be measured reliably. The carrying amount of the replaced part is derecognised. All other repairs and

maintenance are charged to profit or loss during the financial period in which they are incurred.

154 Major spare parts, stand-by equipment and servicing equipment are classified as property, plant and equipment rather

than inventory when they are expected to be used during more than one period.

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

A bearer plant is a living plant that is used in the production or supply of agricultural produce, is expected to bear produce

for more than one period and has a remote likelihood of being sold as agricultural produce, except for incidental scrap

sales. The bearer plants of the Group are oil palms, rubber trees and mango trees. Immature bearer plants are measured

at accumulated costs of planting of bearer plants, similar to accounting for a self-constructed item of property, plant and

equipment. Bearer plants are classified as immature until the trees are available for harvest.

At that point, bearer plants are measured at amortised cost and depreciated over their useful life which is estimated to

be 20 to 25 years.

Freehold land is not depreciated as it has an infinite useful life and assets under construction are not depreciated until

when the assets are ready for their intended use.

All property, plant and equipment are depreciated on a straight line basis to write off the cost of each asset to their

residual values over their estimated useful lives as follows:

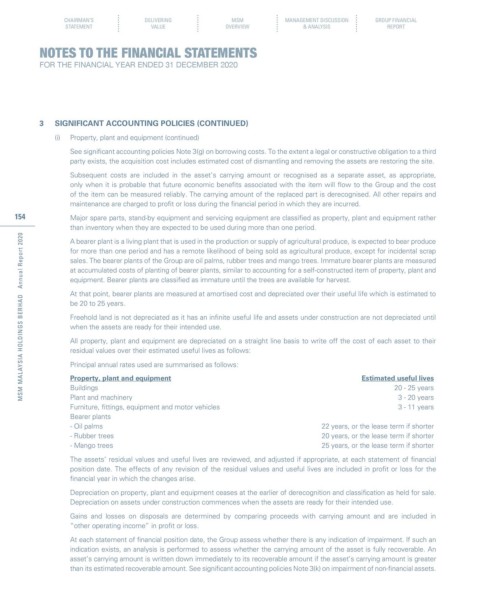

Principal annual rates used are summarised as follows:

Property, plant and equipment Estimated useful lives

Buildings 20 - 25 years

Plant and machinery 3 - 20 years

Furniture, fittings, equipment and motor vehicles 3 - 11 years

Bearer plants

- Oil palms 22 years, or the lease term if shorter

- Rubber trees 20 years, or the lease term if shorter

- Mango trees 25 years, or the lease term if shorter

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each statement of financial

position date. The effects of any revision of the residual values and useful lives are included in profit or loss for the

financial year in which the changes arise.

Depreciation on property, plant and equipment ceases at the earlier of derecognition and classification as held for sale.

Depreciation on assets under construction commences when the assets are ready for their intended use.

Gains and losses on disposals are determined by comparing proceeds with carrying amount and are included in

“other operating income” in profit or loss.

At each statement of financial position date, the Group assess whether there is any indication of impairment. If such an

indication exists, an analysis is performed to assess whether the carrying amount of the asset is fully recoverable. An

asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater

than its estimated recoverable amount. See significant accounting policies Note 3(k) on impairment of non-financial assets.