Page 111 - MSM_AR2020

P. 111

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

ADDITIONAL COMPLIANCE

INFORMATION

In compliance with the Main Market Listing Requirements 6. NON-AUDIT FEES

of Bursa Malaysia Securities Berhad, the following information is During the financial year ended 31 December 2020 there was no non-audit

provided: fee services rendered to the Company by its external auditors.

1. UTILISATION OF PROCEEDS RAISED FROM CORPORATE 7. VARIATION IN RESULTS

PROPOSALS There were no profit estimation, forecasts or projections made or released

There were no proceeds raised from corporate proposals during by the Company during the financial year ended 31 December 2020.

the financial year ended 31 December 2020.

8. PROFIT GUARANTEE

2. SHARE BUY-BACKS No profit guarantee was given by the Company in respect of the financial

During the financial year ended 31 December 2020, there were year ended 31 December 2020.

no share buy-backs by the Company.

9. MATERIAL CONTRACTS

3. OPTION, WARRANTS OR CONVERTIBLE Save for those disclosed in the Financial Statements and below, there is 109

There were no option, warrant or convertible securities issued no other material contract entered into by the Company or its subsidiaries

by the Company during the financial year ended 31 December either still subsisting at the financial year ended 31 December 2020

2020. or entered into since the end of the previous financial year ended

31 December 2019:

4. AMERICANS DEPOSITORY RECEIPT (ADR) OR GLOBAL

DEPOSITORY RECEIPT (GDR) PROGRAMME Sale and purchase agreement dated 8 October 2019 between MSM Perlis

The Company did not sponsor any ADR or GDR programme Sdn Bhd (MSM Perlis) and F&N Agrivalley Sdn Bhd (formerly known as

during the financial year ended 31 December 2020. Rimba Perkasa Sdn Bhd) (F&N) for the disposal of 9 parcels of leasehold

agricultural lands known as “Ladang Chuping” totalling approximately

5. MATERIAL SANCTIONS AND/OR PENALTIES 4,453.92 hectares registered under MSM Perlis to F&N for a total cash

consideration of RM156,000,000.00 only, subject to the terms and

During the financial year ended 31 December 2020, there conditions therein. However, on 9 April 2020, MSM Perlis had issued

were no sanctions and/or penalties imposed on the Company a letter to F&N to exercise its rights to rescind the sale and purchase

and its subsidiaries, directors or management by the relevant agreement.

regulatory bodies. MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

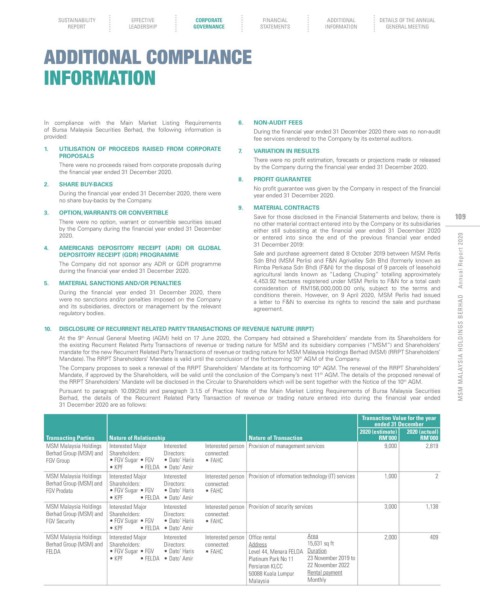

10. DISCLOSURE OF RECURRENT RELATED PARTY TRANSACTIONS OF REVENUE NATURE (RRPT)

th

At the 9 Annual General Meeting (AGM) held on 17 June 2020, the Company had obtained a Shareholders’ mandate from its Shareholders for

the existing Recurrent Related Party Transactions of revenue or trading nature for MSM and its subsidiary companies (“MSM”) and Shareholders’

mandate for the new Recurrent Related Party Transactions of revenue or trading nature for MSM Malaysia Holdings Berhad (MSM) (RRPT Shareholders’

Mandate). The RRPT Shareholders’ Mandate is valid until the conclusion of the forthcoming 10 AGM of the Company.

th

The Company proposes to seek a renewal of the RRPT Shareholders’ Mandate at its forthcoming 10 AGM. The renewal of the RRPT Shareholders’

th

Mandate, if approved by the Shareholders, will be valid until the conclusion of the Company’s next 11 AGM. The details of the proposed renewal of

th

the RRPT Shareholders’ Mandate will be disclosed in the Circular to Shareholders which will be sent together with the Notice of the 10 AGM.

th

Pursuant to paragraph 10.09(2)(b) and paragraph 3.1.5 of Practice Note of the Main Market Listing Requirements of Bursa Malaysia Securities

Berhad, the details of the Recurrent Related Party Transaction of revenue or trading nature entered into during the financial year ended

31 December 2020 are as follows:

transaction Value for the year

ended 31 December

2020 (estimate) 2020 (actual)

transacting Parties nature of Relationship nature of transaction RM’000 RM’000

MSM Malaysia Holdings Interested Major Interested Interested person Provision of management services 9,000 2,819

Berhad Group (MSM) and Shareholders: Directors: connected:

FGV Group • FGV Sugar • FGV • Dato’ Haris • FAHC

• KPF • FELDA • Dato’ Amir

MSM Malaysia Holdings Interested Major Interested Interested person Provision of information technology (IT) services 1,000 2

Berhad Group (MSM) and Shareholders: Directors: connected:

FGV Prodata • FGV Sugar • FGV • Dato’ Haris • FAHC

• KPF • FELDA • Dato’ Amir

MSM Malaysia Holdings Interested Major Interested Interested person Provision of security services 3,000 1,138

Berhad Group (MSM) and Shareholders: Directors: connected:

FGV Security • FGV Sugar • FGV • Dato’ Haris • FAHC

• KPF • FELDA • Dato’ Amir

MSM Malaysia Holdings Interested Major Interested Interested person Office rental Area 2,000 409

Berhad Group (MSM) and Shareholders: Directors: connected: Address 15,631 sq ft

FELDA • FGV Sugar • FGV • Dato’ Haris • FAHC Level 44, Menara FELDA Duration

• KPF • FELDA • Dato’ Amir Platinum Park No 11 23 November 2019 to

Persiaran KLCC 22 November 2022

50088 Kuala Lumpur Rental payment

Malaysia Monthly