Page 116 - MSM_AR2020

P. 116

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

STATEMENT ON RISk MANAGEMENT AND INTERNAL CONTROL

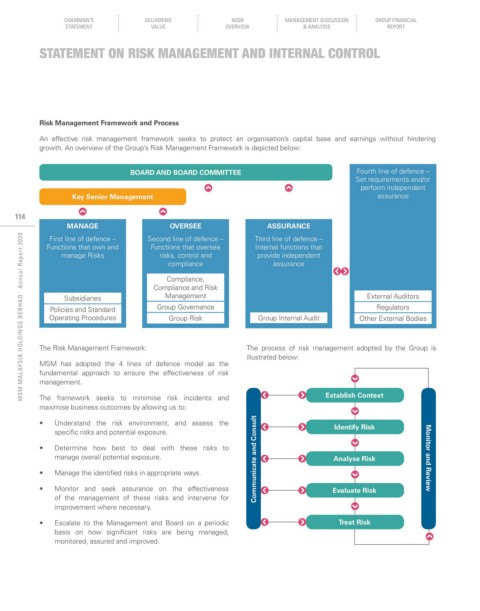

Risk Management Framework and Process

An effective risk management framework seeks to protect an organisation’s capital base and earnings without hindering

growth. An overview of the Group’s Risk Management Framework is depicted below:

BOARD AND BOARD COMMITTEE Fourth line of defence –

Set requirements and/or

perform independent

Key Senior Management assurance

114

MANAGE OVERSEE ASSURANCE

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

First line of defence – Second line of defence – Third line of defence –

Functions that own and Functions that oversee Internal functions that

manage Risks risks, control and provide independent

compliance assurance

Compliance,

Compliance and Risk

Subsidiaries Management External Auditors

Policies and Standard Group Governance Regulators

Operating Procedures Group Risk Group Internal Audit Other External Bodies

The Risk Management Framework: The process of risk management adopted by the Group is

illustrated below:

MSM has adopted the 4 lines of defence model as the

fundamental approach to ensure the effectiveness of risk

management.

The framework seeks to minimise risk incidents and Establish Context

maximise business outcomes by allowing us to:

• Understand the risk environment, and assess the Identify Risk

specific risks and potential exposure.

• Determine how best to deal with these risks to

manage overall potential exposure. Communicate and Consult Analyse Risk Monitor and Review

• Manage the identified risks in appropriate ways.

• Monitor and seek assurance on the effectiveness Evaluate Risk

of the management of these risks and intervene for

improvement where necessary.

• Escalate to the Management and Board on a periodic Treat Risk

basis on how significant risks are being managed,

monitored, assured and improved.