Page 117 - MSM_AR2020

P. 117

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

Enterprise Risk Management (ERM) System

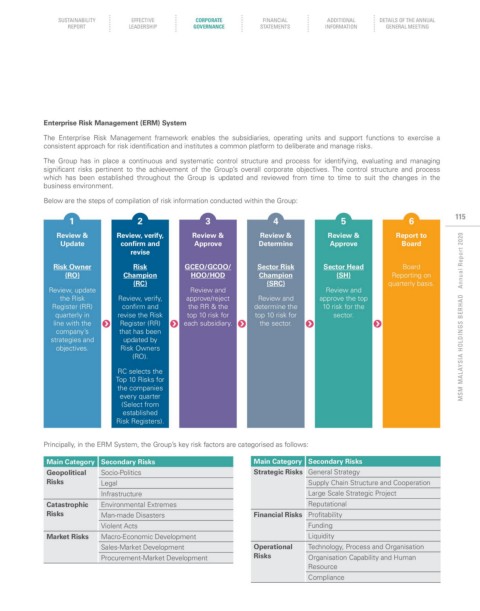

The Enterprise Risk Management framework enables the subsidiaries, operating units and support functions to exercise a

consistent approach for risk identification and institutes a common platform to deliberate and manage risks.

The Group has in place a continuous and systematic control structure and process for identifying, evaluating and managing

significant risks pertinent to the achievement of the Group’s overall corporate objectives. The control structure and process

which has been established throughout the Group is updated and reviewed from time to time to suit the changes in the

business environment.

Below are the steps of compilation of risk information conducted within the Group:

1 2 3 4 5 6 115

Review & Review, verify, Review & Review & Review & Report to

Update confirm and Approve Determine Approve Board

revise

Risk Owner Risk GCEO/GCOO/ Sector Risk Sector Head Board

(RO) Champion HOO/HOD Champion (SH) Reporting on

(RC) (SRC) quarterly basis.

Review, update Review and Review and

the Risk Review, verify, approve/reject Review and approve the top

Register (RR) confirm and the RR & the determine the 10 risk for the

quarterly in revise the Risk top 10 risk for top 10 risk for sector. MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

line with the Register (RR) each subsidiary. the sector.

company’s that has been

strategies and updated by

objectives. Risk Owners

(RO).

RC selects the

Top 10 Risks for

the companies

every quarter

(Select from

established

Risk Registers).

Principally, in the ERM System, the Group’s key risk factors are categorised as follows:

Main Category Secondary Risks Main Category Secondary Risks

Geopolitical Socio-Politics Strategic Risks General Strategy

Risks Legal Supply Chain Structure and Cooperation

Infrastructure Large Scale Strategic Project

Catastrophic Environmental Extremes Reputational

Risks Man-made Disasters Financial Risks Profitability

Violent Acts Funding

Market Risks Macro-Economic Development Liquidity

Sales-Market Development Operational Technology, Process and Organisation

Procurement-Market Development Risks Organisation Capability and Human

Resource

Compliance