Page 184 - MSM_AR2020

P. 184

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

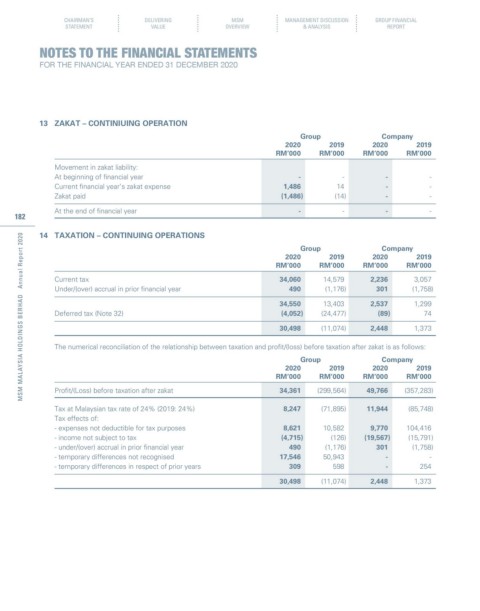

13 ZAKAT – CONTINIUING OPERATION

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Movement in zakat liability:

At beginning of financial year - - - -

Current financial year’s zakat expense 1,486 14 - -

Zakat paid (1,486) (14) - -

At the end of financial year - - - -

182

14 TAXATION – CONTINUING OPERATIONS

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Current tax 34,060 14,579 2,236 3,057

Under/(over) accrual in prior financial year 490 (1,176) 301 (1,758)

34,550 13,403 2,537 1,299

Deferred tax (Note 32) (4,052) (24,477) (89) 74

30,498 (11,074) 2,448 1,373

The numerical reconciliation of the relationship between taxation and profit/(loss) before taxation after zakat is as follows:

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Profit/(Loss) before taxation after zakat 34,361 (299,564) 49,766 (357,283)

Tax at Malaysian tax rate of 24% (2019: 24%) 8,247 (71,895) 11,944 (85,748)

Tax effects of:

- expenses not deductible for tax purposes 8,621 10,582 9,770 104,416

- income not subject to tax (4,715) (126) (19,567) (15,791)

- under/(over) accrual in prior financial year 490 (1,176) 301 (1,758)

- temporary differences not recognised 17,546 50,943 - -

- temporary differences in respect of prior years 309 598 - 254

30,498 (11,074) 2,448 1,373