Page 186 - MSM_AR2020

P. 186

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

16 LOSS FROM DISCONTINUING OPERATION (CONTINUED)

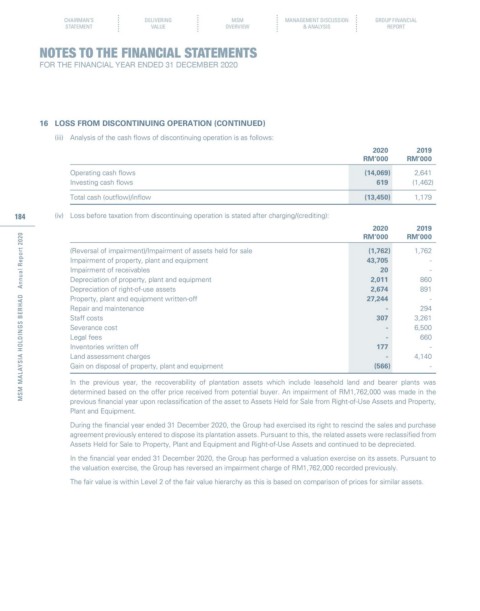

(iii) Analysis of the cash flows of discontinuing operation is as follows:

2020 2019

RM’000 RM’000

Operating cash flows (14,069) 2,641

Investing cash flows 619 (1,462)

Total cash (outflow)/inflow (13,450) 1,179

184 (iv) Loss before taxation from discontinuing operation is stated after charging/(crediting):

2020 2019

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

RM’000 RM’000

(Reversal of impairment)/Impairment of assets held for sale (1,762) 1,762

Impairment of property, plant and equipment 43,705 -

Impairment of receivables 20 -

Depreciation of property, plant and equipment 2,011 860

Depreciation of right-of-use assets 2,674 891

Property, plant and equipment written-off 27,244 -

Repair and maintenance - 294

Staff costs 307 3,261

Severance cost - 6,500

Legal fees - 660

Inventories written off 177 -

Land assessment charges - 4,140

Gain on disposal of property, plant and equipment (566) -

In the previous year, the recoverability of plantation assets which include leasehold land and bearer plants was

determined based on the offer price received from potential buyer. An impairment of RM1,762,000 was made in the

previous financial year upon reclassification of the asset to Assets Held for Sale from Right-of-Use Assets and Property,

Plant and Equipment.

During the financial year ended 31 December 2020, the Group had exercised its right to rescind the sales and purchase

agreement previously entered to dispose its plantation assets. Pursuant to this, the related assets were reclassified from

Assets Held for Sale to Property, Plant and Equipment and Right-of-Use Assets and continued to be depreciated.

In the financial year ended 31 December 2020, the Group has performed a valuation exercise on its assets. Pursuant to

the valuation exercise, the Group has reversed an impairment charge of RM1,762,000 recorded previously.

The fair value is within Level 2 of the fair value hierarchy as this is based on comparison of prices for similar assets.