Page 190 - MSM_AR2020

P. 190

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

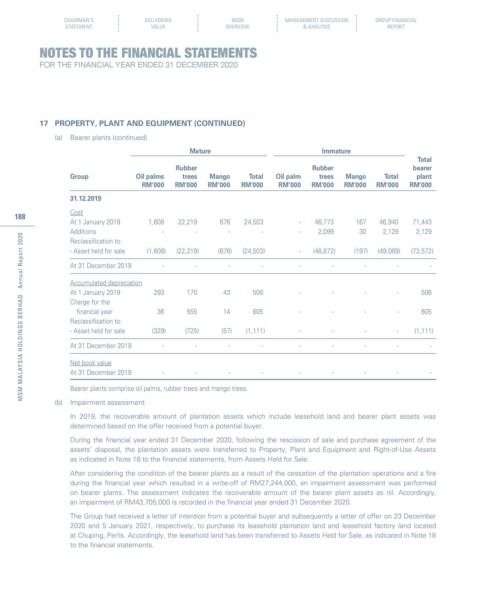

17 PROPERTY, PLANT AND EQUIPMENT (CONTINUED)

(a) Bearer plants (continued)

Mature Immature

Total

Rubber Rubber bearer

Group Oil palms trees Mango Total Oil palm trees Mango Total plant

RM'000 RM'000 RM’000 RM'000 RM’000 RM'000 RM'000 RM'000 RM'000

31.12.2019

Cost

188

At 1 January 2019 1,608 22,219 676 24,503 - 46,773 167 46,940 71,443

Additions - - - - - 2,099 30 2,129 2,129

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Reclassification to:

- Asset held for sale (1,608) (22,219) (676) (24,503) - (48,872) (197) (49,069) (73,572)

At 31 December 2019 - - - - - - - - -

Accumulated depreciation

At 1 January 2019 293 170 43 506 - - - - 506

Charge for the

financial year 36 555 14 605 - - - - 605

Reclassification to:

- Asset held for sale (329) (725) (57) (1,111) - - - - (1,111)

At 31 December 2019 - - - - - - - - -

Net book value

At 31 December 2019 - - - - - - - - -

Bearer plants comprise oil palms, rubber trees and mango trees.

(b) Impairment assessment

In 2019, the recoverable amount of plantation assets which include leasehold land and bearer plant assets was

determined based on the offer received from a potential buyer.

During the financial year ended 31 December 2020, following the rescission of sale and purchase agreement of the

assets’ disposal, the plantation assets were transferred to Property, Plant and Equipment and Right-of-Use Assets

as indicated in Note 18 to the financial statements, from Assets Held for Sale.

After considering the condition of the bearer plants as a result of the cessation of the plantation operations and a fire

during the financial year which resulted in a write-off of RM27,244,000, an impairment assessment was performed

on bearer plants. The assessment indicates the recoverable amount of the bearer plant assets as nil. Accordingly,

an impairment of RM43,705,000 is recorded in the financial year ended 31 December 2020.

The Group had received a letter of intention from a potential buyer and subsequently a letter of offer on 23 December

2020 and 5 January 2021, respectively, to purchase its leasehold plantation land and leasehold factory land located

at Chuping, Perlis. Accordingly, the leasehold land has been transferred to Assets Held for Sale, as indicated in Note 18

to the financial statements.