Page 131 - MSM_AR2020

P. 131

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

INDEPENDENT AUDITORS’ REPORT

TO THE MEMBERS OF MSM MALAYSIA HOLDINGS BERHAD

(INCORPORATED IN MALAYSIA) REGISTRATION NO. 201101007583 (935722-K)

REPORT ON THE AUDIT OF THE FINANCIAL STATEMENTS (continued)

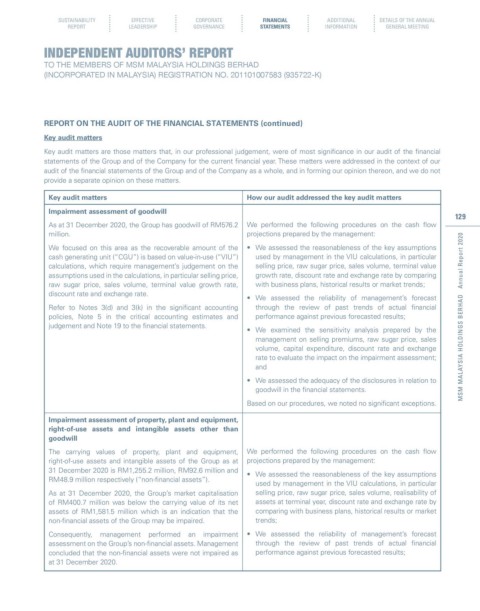

Key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the financial

statements of the Group and of the Company for the current financial year. These matters were addressed in the context of our

audit of the financial statements of the Group and of the Company as a whole, and in forming our opinion thereon, and we do not

provide a separate opinion on these matters.

Key audit matters How our audit addressed the key audit matters

Impairment assessment of goodwill

129

As at 31 December 2020, the Group has goodwill of RM576.2 We performed the following procedures on the cash flow

million. projections prepared by the management:

We focused on this area as the recoverable amount of the • We assessed the reasonableness of the key assumptions

cash generating unit (“CGU”) is based on value-in-use (“VIU”) used by management in the VIU calculations, in particular

calculations, which require management’s judgement on the selling price, raw sugar price, sales volume, terminal value

assumptions used in the calculations, in particular selling price, growth rate, discount rate and exchange rate by comparing

raw sugar price, sales volume, terminal value growth rate, with business plans, historical results or market trends;

discount rate and exchange rate.

• We assessed the reliability of management’s forecast

Refer to Notes 3(d) and 3(k) in the significant accounting through the review of past trends of actual financial

policies, Note 5 in the critical accounting estimates and performance against previous forecasted results; MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

judgement and Note 19 to the financial statements.

• We examined the sensitivity analysis prepared by the

management on selling premiums, raw sugar price, sales

volume, capital expenditure, discount rate and exchange

rate to evaluate the impact on the impairment assessment;

and

• We assessed the adequacy of the disclosures in relation to

goodwill in the financial statements.

Based on our procedures, we noted no significant exceptions.

Impairment assessment of property, plant and equipment,

right-of-use assets and intangible assets other than

goodwill

The carrying values of property, plant and equipment, We performed the following procedures on the cash flow

right-of-use assets and intangible assets of the Group as at projections prepared by the management:

31 December 2020 is RM1,255.2 million, RM92.6 million and • We assessed the reasonableness of the key assumptions

RM48.9 million respectively (“non-financial assets”).

used by management in the VIU calculations, in particular

As at 31 December 2020, the Group’s market capitalisation selling price, raw sugar price, sales volume, realisability of

of RM400.7 million was below the carrying value of its net assets at terminal year, discount rate and exchange rate by

assets of RM1,581.5 million which is an indication that the comparing with business plans, historical results or market

non-financial assets of the Group may be impaired. trends;

Consequently, management performed an impairment • We assessed the reliability of management’s forecast

assessment on the Group’s non-financial assets. Management through the review of past trends of actual financial

concluded that the non-financial assets were not impaired as performance against previous forecasted results;

at 31 December 2020.