Page 132 - MSM_AR2020

P. 132

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

INDEPENDENT AUDITORS’ REPORT

TO THE MEMBERS OF MSM MALAYSIA HOLDINGS BERHAD

(INCORPORATED IN MALAYSIA) REGISTRATION NO. 201101007583 (935722-K)

REPORT ON THE AUDIT OF THE FINANCIAL STATEMENTS (continued)

Key audit matters (continued)

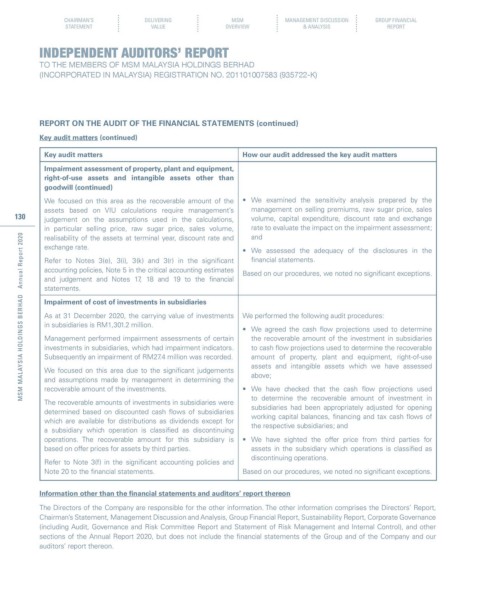

Key audit matters How our audit addressed the key audit matters

Impairment assessment of property, plant and equipment,

right-of-use assets and intangible assets other than

goodwill (continued)

We focused on this area as the recoverable amount of the • We examined the sensitivity analysis prepared by the

assets based on VIU calculations require management’s management on selling premiums, raw sugar price, sales

130 judgement on the assumptions used in the calculations, volume, capital expenditure, discount rate and exchange

in particular selling price, raw sugar price, sales volume, rate to evaluate the impact on the impairment assessment;

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

realisability of the assets at terminal year, discount rate and and

exchange rate. • We assessed the adequacy of the disclosures in the

Refer to Notes 3(e), 3(i), 3(k) and 3(r) in the significant financial statements.

accounting policies, Note 5 in the critical accounting estimates Based on our procedures, we noted no significant exceptions.

and judgement and Notes 17, 18 and 19 to the financial

statements.

Impairment of cost of investments in subsidiaries

As at 31 December 2020, the carrying value of investments We performed the following audit procedures:

in subsidiaries is RM1,301.2 million.

• We agreed the cash flow projections used to determine

Management performed impairment assessments of certain the recoverable amount of the investment in subsidiaries

investments in subsidiaries, which had impairment indicators. to cash flow projections used to determine the recoverable

Subsequently an impairment of RM27.4 million was recorded. amount of property, plant and equipment, right-of-use

assets and intangible assets which we have assessed

We focused on this area due to the significant judgements above;

and assumptions made by management in determining the

recoverable amount of the investments. • We have checked that the cash flow projections used

to determine the recoverable amount of investment in

The recoverable amounts of investments in subsidiaries were

determined based on discounted cash flows of subsidiaries subsidiaries had been appropriately adjusted for opening

which are available for distributions as dividends except for working capital balances, financing and tax cash flows of

a subsidiary which operation is classified as discontinuing the respective subsidiaries; and

operations. The recoverable amount for this subsidiary is • We have sighted the offer price from third parties for

based on offer prices for assets by third parties. assets in the subsidiary which operations is classified as

discontinuing operations.

Refer to Note 3(f) in the significant accounting policies and

Note 20 to the financial statements. Based on our procedures, we noted no significant exceptions.

Information other than the financial statements and auditors’ report thereon

The Directors of the Company are responsible for the other information. The other information comprises the Directors’ Report,

Chairman’s Statement, Management Discussion and Analysis, Group Financial Report, Sustainability Report, Corporate Governance

(including Audit, Governance and Risk Committee Report and Statement of Risk Management and Internal Control), and other

sections of the Annual Report 2020, but does not include the financial statements of the Group and of the Company and our

auditors’ report thereon.