Page 168 - MSM_AR2020

P. 168

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

4 FINANCIAL RISK MANAGEMENT (CONTINUED)

(a) Financial risk management policies (continued)

Market risk (continued)

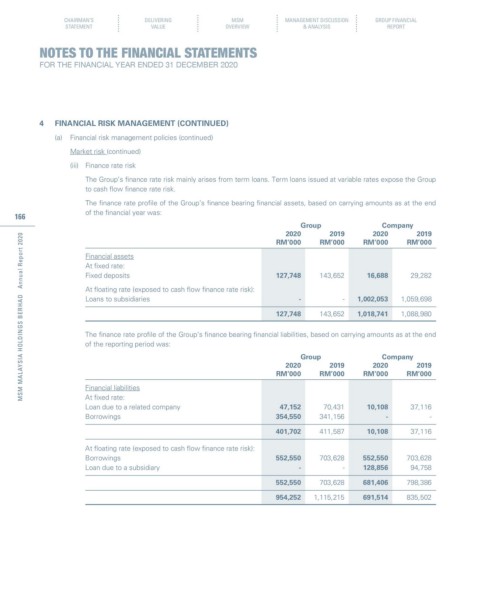

(iii) Finance rate risk

The Group’s finance rate risk mainly arises from term loans. Term loans issued at variable rates expose the Group

to cash flow finance rate risk.

The finance rate profile of the Group’s finance bearing financial assets, based on carrying amounts as at the end

of the financial year was:

166

Group Company

2020 2019 2020 2019

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

RM’000 RM’000 RM’000 RM’000

Financial assets

At fixed rate:

Fixed deposits 127,748 143,652 16,688 29,282

At floating rate (exposed to cash flow finance rate risk):

Loans to subsidiaries - - 1,002,053 1,059,698

127,748 143,652 1,018,741 1,088,980

The finance rate profile of the Group’s finance bearing financial liabilities, based on carrying amounts as at the end

of the reporting period was:

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Financial liabilities

At fixed rate:

Loan due to a related company 47,152 70,431 10,108 37,116

Borrowings 354,550 341,156 - -

401,702 411,587 10,108 37,116

At floating rate (exposed to cash flow finance rate risk):

Borrowings 552,550 703,628 552,550 703,628

Loan due to a subsidiary - - 128,856 94,758

552,550 703,628 681,406 798,386

954,252 1,115,215 691,514 835,502