Page 172 - MSM_AR2020

P. 172

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

4 FINANCIAL RISK MANAGEMENT (CONTINUED)

(a) Financial risk management policies (continued)

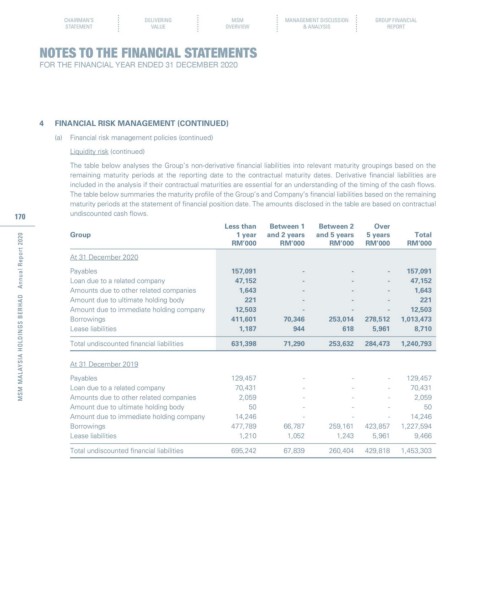

Liquidity risk (continued)

The table below analyses the Group’s non-derivative financial liabilities into relevant maturity groupings based on the

remaining maturity periods at the reporting date to the contractual maturity dates. Derivative financial liabilities are

included in the analysis if their contractual maturities are essential for an understanding of the timing of the cash flows.

The table below summaries the maturity profile of the Group’s and Company’s financial liabilities based on the remaining

maturity periods at the statement of financial position date. The amounts disclosed in the table are based on contractual

170 undiscounted cash flows.

Less than Between 1 Between 2 Over

Group 1 year and 2 years and 5 years 5 years Total

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

RM’000 RM’000 RM’000 RM’000 RM’000

At 31 December 2020

Payables 157,091 - - - 157,091

Loan due to a related company 47,152 - - - 47,152

Amounts due to other related companies 1,643 - - - 1,643

Amount due to ultimate holding body 221 - - - 221

Amount due to immediate holding company 12,503 - - - 12,503

Borrowings 411,601 70,346 253,014 278,512 1,013,473

Lease liabilities 1,187 944 618 5,961 8,710

Total undiscounted financial liabilities 631,398 71,290 253,632 284,473 1,240,793

At 31 December 2019

Payables 129,457 - - - 129,457

Loan due to a related company 70,431 - - - 70,431

Amounts due to other related companies 2,059 - - - 2,059

Amount due to ultimate holding body 50 - - - 50

Amount due to immediate holding company 14,246 - - - 14,246

Borrowings 477,789 66,787 259,161 423,857 1,227,594

Lease liabilities 1,210 1,052 1,243 5,961 9,466

Total undiscounted financial liabilities 695,242 67,839 260,404 429,818 1,453,303