Page 170 - MSM_AR2020

P. 170

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

4 FINANCIAL RISK MANAGEMENT (CONTINUED)

(a) Financial risk management policies (continued)

Credit risk (continued)

(a) Impairment of financial assets (continued)

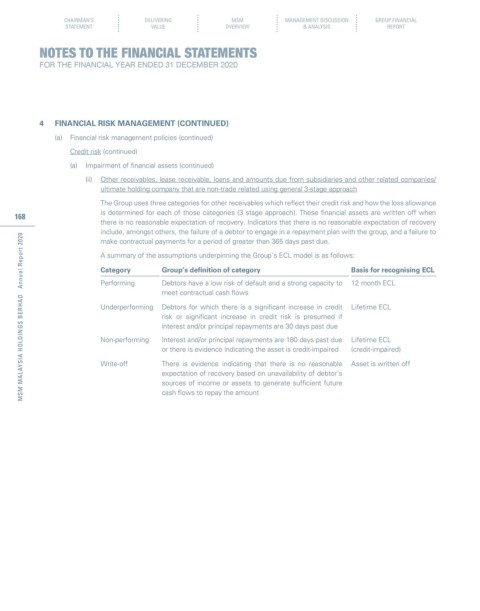

(ii) Other receivables, lease receivable, loans and amounts due from subsidiaries and other related companies/

ultimate holding company that are non-trade related using general 3-stage approach

The Group uses three categories for other receivables which reflect their credit risk and how the loss allowance

is determined for each of those categories (3 stage approach). These financial assets are written off when

168

there is no reasonable expectation of recovery. Indicators that there is no reasonable expectation of recovery

include, amongst others, the failure of a debtor to engage in a repayment plan with the group, and a failure to

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

make contractual payments for a period of greater than 365 days past due.

A summary of the assumptions underpinning the Group’s ECL model is as follows:

Category Group’s definition of category Basis for recognising ECL

Performing Debtors have a low risk of default and a strong capacity to 12 month ECL

meet contractual cash flows

Underperforming Debtors for which there is a significant increase in credit Lifetime ECL

risk or significant increase in credit risk is presumed if

interest and/or principal repayments are 30 days past due

Non-performing Interest and/or principal repayments are 180 days past due Lifetime ECL

or there is evidence indicating the asset is credit-impaired (credit-impaired)

Write-off There is evidence indicating that there is no reasonable Asset is written off

expectation of recovery based on unavailability of debtor’s

sources of income or assets to generate sufficient future

cash flows to repay the amount