Page 224 - MSM_AR2020

P. 224

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

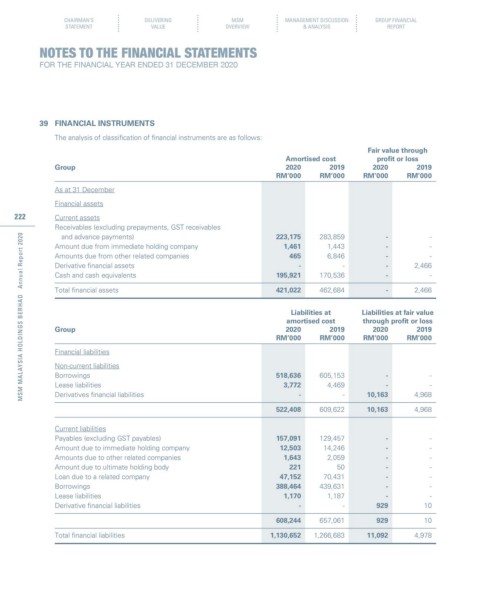

39 FINANCIAL INSTRUMENTS

The analysis of classification of financial instruments are as follows:

Fair value through

Amortised cost profit or loss

Group 2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

As at 31 December

Financial assets

222 Current assets

Receivables (excluding prepayments, GST receivables

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

and advance payments) 223,175 283,859 - -

Amount due from immediate holding company 1,461 1,443 - -

Amounts due from other related companies 465 6,846 - -

Derivative financial assets - - - 2,466

Cash and cash equivalents 195,921 170,536 - -

Total financial assets 421,022 462,684 - 2,466

Liabilities at Liabilities at fair value

amortised cost through profit or loss

Group 2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Financial liabilities

Non-current liabilities

Borrowings 518,636 605,153 - -

Lease liabilities 3,772 4,469 - -

Derivatives financial liabilities - - 10,163 4,968

522,408 609,622 10,163 4,968

Current liabilities

Payables (excluding GST payables) 157,091 129,457 - -

Amount due to immediate holding company 12,503 14,246 - -

Amounts due to other related companies 1,643 2,059 - -

Amount due to ultimate holding body 221 50 - -

Loan due to a related company 47,152 70,431 - -

Borrowings 388,464 439,631 - -

Lease liabilities 1,170 1,187 - -

Derivative financial liabilities - - 929 10

608,244 657,061 929 10

Total financial liabilities 1,130,652 1,266,683 11,092 4,978