Page 226 - MSM_AR2020

P. 226

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

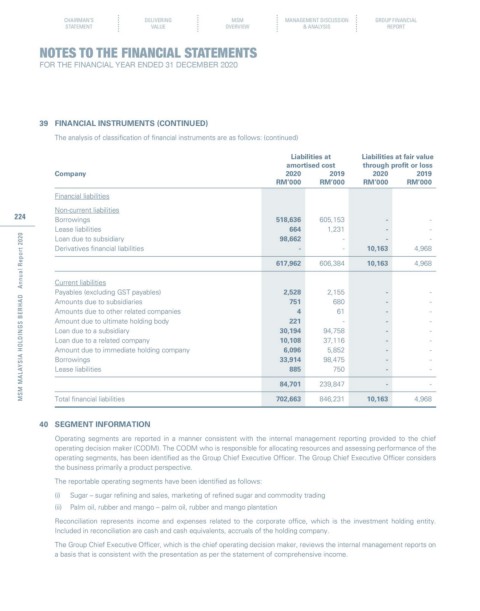

39 FINANCIAL INSTRUMENTS (CONTINUED)

The analysis of classification of financial instruments are as follows: (continued)

Liabilities at Liabilities at fair value

amortised cost through profit or loss

Company 2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Financial liabilities

Non-current liabilities

224 Borrowings 518,636 605,153 - -

Lease liabilities 664 1,231 - -

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Loan due to subsidiary 98,662 - - -

Derivatives financial liabilities - - 10,163 4,968

617,962 606,384 10,163 4,968

Current liabilities

Payables (excluding GST payables) 2,528 2,155 - -

Amounts due to subsidiaries 751 680 - -

Amounts due to other related companies 4 61 - -

Amount due to ultimate holding body 221 - - -

Loan due to a subsidiary 30,194 94,758 - -

Loan due to a related company 10,108 37,116 - -

Amount due to immediate holding company 6,096 5,852 - -

Borrowings 33,914 98,475 - -

Lease liabilities 885 750 - -

84,701 239,847 - -

Total financial liabilities 702,663 846,231 10,163 4,968

40 SEGMENT INFORMATION

Operating segments are reported in a manner consistent with the internal management reporting provided to the chief

operating decision maker (CODM). The CODM who is responsible for allocating resources and assessing performance of the

operating segments, has been identified as the Group Chief Executive Officer. The Group Chief Executive Officer considers

the business primarily a product perspective.

The reportable operating segments have been identified as follows:

(i) Sugar – sugar refining and sales, marketing of refined sugar and commodity trading

(ii) Palm oil, rubber and mango – palm oil, rubber and mango plantation

Reconciliation represents income and expenses related to the corporate office, which is the investment holding entity.

Included in reconciliation are cash and cash equivalents, accruals of the holding company.

The Group Chief Executive Officer, which is the chief operating decision maker, reviews the internal management reports on

a basis that is consistent with the presentation as per the statement of comprehensive income.