Page 196 - MSM_AR2020

P. 196

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

19 INTANGIBLE ASSETS (CONTINUED)

Goodwill

The goodwill relates to the acquisition of the sugar business and is allocated to the sugar segment. This represents the lowest

level at which goodwill is monitored for internal management purposes.

The recoverable amount of the Cash Generating Unit (“CGU”) is determined based on value-in-use (“VIU”) calculations using

cash flows projections based on financial budgets approved by the Directors covering an eight-year period and applying a

terminal value multiple using a long term sustainable growth rate. An extended forecast period of eight years is used to show

the full impact following the rationalisation plan within the Group.

194 The recoverable amount calculated based on VIU exceeded the carrying value by RM257 million (2019: RM144 million).

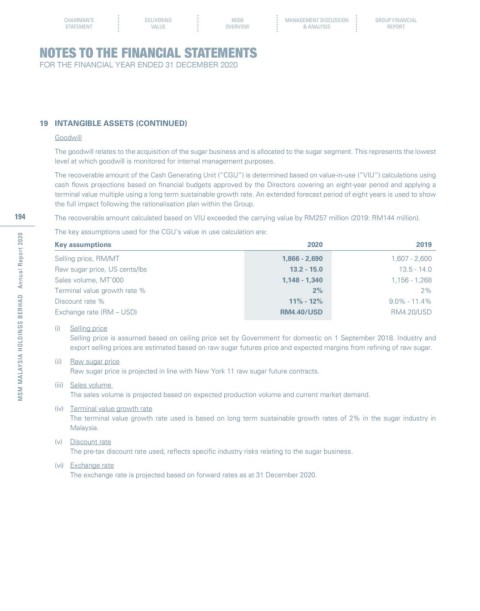

The key assumptions used for the CGU’s value in use calculation are:

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Key assumptions 2020 2019

Selling price, RM/MT 1,866 - 2,690 1,607 - 2,600

Raw sugar price, US cents/lbs 13.2 - 15.0 13.5 - 14.0

Sales volume, MT’000 1,148 - 1,340 1,156 - 1,268

Terminal value growth rate % 2% 2%

Discount rate % 11% - 12% 9.0% - 11.4%

Exchange rate (RM – USD) RM4.40/USD RM4.20/USD

(i) Selling price

Selling price is assumed based on ceiling price set by Government for domestic on 1 September 2018. Industry and

export selling prices are estimated based on raw sugar futures price and expected margins from refining of raw sugar.

(ii) Raw sugar price

Raw sugar price is projected in line with New York 11 raw sugar future contracts.

(iii) Sales volume

The sales volume is projected based on expected production volume and current market demand.

(iv) Terminal value growth rate

The terminal value growth rate used is based on long term sustainable growth rates of 2% in the sugar industry in

Malaysia.

(v) Discount rate

The pre-tax discount rate used, reflects specific industry risks relating to the sugar business.

(vi) Exchange rate

The exchange rate is projected based on forward rates as at 31 December 2020.