Page 197 - MSM_AR2020

P. 197

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

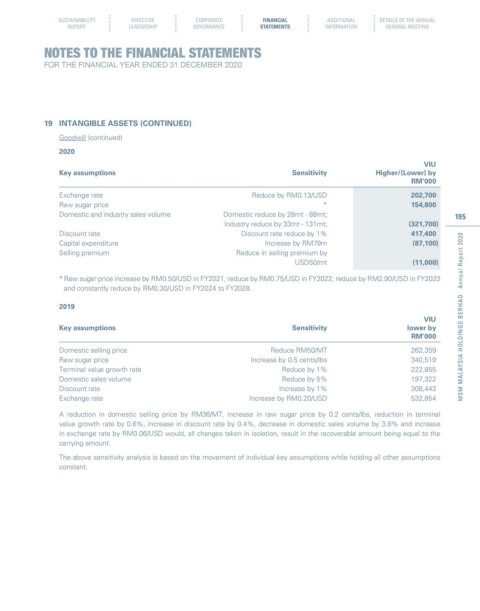

19 INTANGIBLE ASSETS (CONTINUED)

Goodwill (continued)

2020

VIU

Key assumptions Sensitivity Higher/(Lower) by

RM’000

Exchange rate Reduce by RM0.13/USD 202,700

Raw sugar price * 154,800

Domestic and industry sales volume Domestic reduce by 28mt - 88mt; 195

Industry reduce by 33mt - 131mt; (321,700)

Discount rate Discount rate reduce by 1% 417,400

Capital expenditure Increase by RM79m (87,100)

Selling premium Reduce in selling premium by

USD50/mt (11,000)

* Raw sugar price increase by RM0.50/USD in FY2021, reduce by RM0.75/USD in FY2022, reduce by RM2.90/USD in FY2023

and constantly reduce by RM0.30/USD in FY2024 to FY2028.

2019

VIU MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Key assumptions Sensitivity lower by

RM’000

Domestic selling price Reduce RM50/MT 262,359

Raw sugar price Increase by 0.5 cents/lbs 340,519

Terminal value growth rate Reduce by 1% 222,855

Domestic sales volume Reduce by 5% 197,322

Discount rate Increase by 1% 308,443

Exchange rate Increase by RM0.20/USD 532,854

A reduction in domestic selling price by RM36/MT, increase in raw sugar price by 0.2 cents/lbs, reduction in terminal

value growth rate by 0.6%, increase in discount rate by 0.4%, decrease in domestic sales volume by 3.8% and increase

in exchange rate by RM0.06/USD would, all changes taken in isolation, result in the recoverable amount being equal to the

carrying amount.

The above sensitivity analysis is based on the movement of individual key assumptions while holding all other assumptions

constant.