Page 200 - MSM_AR2020

P. 200

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

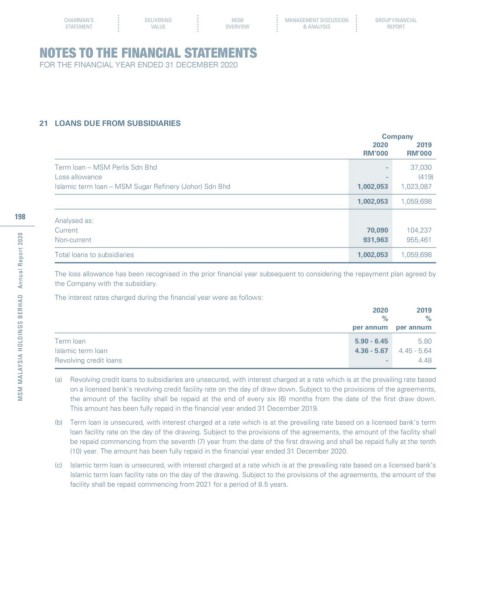

21 LOANS DUE FROM SUBSIDIARIES

Company

2020 2019

RM’000 RM’000

Term loan – MSM Perlis Sdn Bhd - 37,030

Loss allowance - (419)

Islamic term loan – MSM Sugar Refinery (Johor) Sdn Bhd 1,002,053 1,023,087

1,002,053 1,059,698

198 Analysed as:

Current 70,090 104,237

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Non-current 931,963 955,461

Total loans to subsidiaries 1,002,053 1,059,698

The loss allowance has been recognised in the prior financial year subsequent to considering the repayment plan agreed by

the Company with the subsidiary.

The interest rates charged during the financial year were as follows:

2020 2019

% %

per annum per annum

Term loan 5.90 - 6.45 5.80

Islamic term loan 4.36 - 5.67 4.45 - 5.64

Revolving credit loans - 4.48

(a) Revolving credit loans to subsidiaries are unsecured, with interest charged at a rate which is at the prevailing rate based

on a licensed bank’s revolving credit facility rate on the day of draw down. Subject to the provisions of the agreements,

the amount of the facility shall be repaid at the end of every six (6) months from the date of the first draw down.

This amount has been fully repaid in the financial year ended 31 December 2019.

(b) Term loan is unsecured, with interest charged at a rate which is at the prevailing rate based on a licensed bank’s term

loan facility rate on the day of the drawing. Subject to the provisions of the agreements, the amount of the facility shall

be repaid commencing from the seventh (7) year from the date of the first drawing and shall be repaid fully at the tenth

(10) year. The amount has been fully repaid in the financial year ended 31 December 2020.

(c) Islamic term loan is unsecured, with interest charged at a rate which is at the prevailing rate based on a licensed bank’s

Islamic term loan facility rate on the day of the drawing. Subject to the provisions of the agreements, the amount of the

facility shall be repaid commencing from 2021 for a period of 8.5 years.