Page 205 - MSM_AR2020

P. 205

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

23 RECEIVABLES (CONTINUED)

(d) Reconciliation of loss allowance (continued)

(i) Trade receivables using simplified approach (continued)

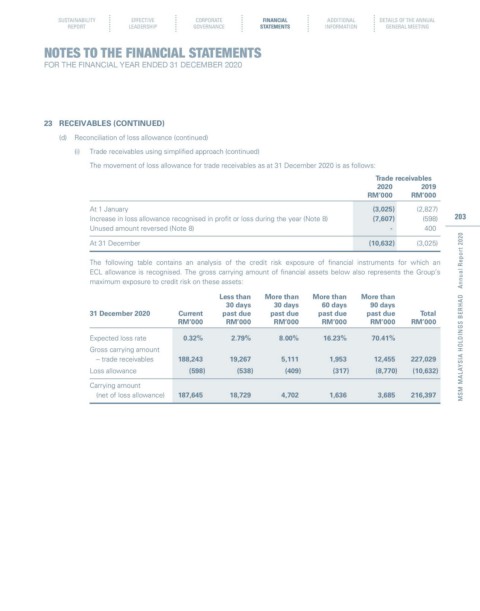

The movement of loss allowance for trade receivables as at 31 December 2020 is as follows:

Trade receivables

2020 2019

RM’000 RM’000

At 1 January (3,025) (2,827)

Increase in loss allowance recognised in profit or loss during the year (Note 8) (7,607) (598) 203

Unused amount reversed (Note 8) - 400

At 31 December (10,632) (3,025)

The following table contains an analysis of the credit risk exposure of financial instruments for which an

ECL allowance is recognised. The gross carrying amount of financial assets below also represents the Group’s

maximum exposure to credit risk on these assets:

Less than More than More than More than

30 days 30 days 60 days 90 days

31 December 2020 Current past due past due past due past due Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Expected loss rate 0.32% 2.79% 8.00% 16.23% 70.41%

Gross carrying amount

– trade receivables 188,243 19,267 5,111 1,953 12,455 227,029

Loss allowance (598) (538) (409) (317) (8,770) (10,632)

Carrying amount

(net of loss allowance) 187,645 18,729 4,702 1,636 3,685 216,397