Page 210 - MSM_AR2020

P. 210

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

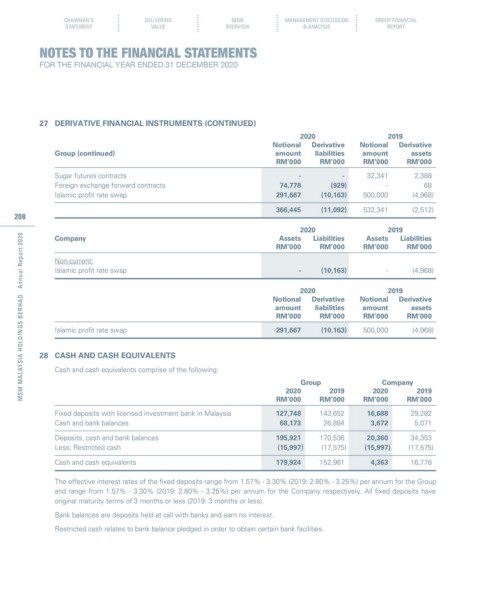

27 DERIVATIVE FINANCIAL INSTRUMENTS (CONTINUED)

2020 2019

Notional Derivative Notional Derivative

Group (continued) amount liabilities amount assets

RM’000 RM’000 RM’000 RM’000

Sugar futures contracts - - 32,341 2,388

Foreign exchange forward contracts 74,778 (929) - 68

Islamic profit rate swap 291,667 (10,163) 500,000 (4,968)

366,445 (11,092) 532,341 (2,512)

208

2020 2019

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Company Assets Liabilities Assets Liabilities

RM’000 RM’000 RM’000 RM’000

Non-current:

Islamic profit rate swap - (10,163) - (4,968)

2020 2019

Notional Derivative Notional Derivative

amount liabilities amount assets

RM’000 RM’000 RM’000 RM’000

Islamic profit rate swap 291,667 (10,163) 500,000 (4,968)

28 CASH AND CASH EQUIVALENTS

Cash and cash equivalents comprise of the following:

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Fixed deposits with licensed investment bank in Malaysia 127,748 143,652 16,688 29,282

Cash and bank balances 68,173 26,884 3,672 5,071

Deposits, cash and bank balances 195,921 170,536 20,360 34,353

Less: Restricted cash (15,997) (17,575) (15,997) (17,575)

Cash and cash equivalents 179,924 152,961 4,363 16,778

The effective interest rates of the fixed deposits range from 1.57% - 3.30% (2019: 2.80% - 3.25%) per annum for the Group

and range from 1.57% - 3.30% (2019: 2.80% - 3.25%) per annum for the Company respectively. All fixed deposits have

original maturity terms of 3 months or less (2019: 3 months or less).

Bank balances are deposits held at call with banks and earn no interest.

Restricted cash relates to bank balance pledged in order to obtain certain bank facilities.