Page 211 - MSM_AR2020

P. 211

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

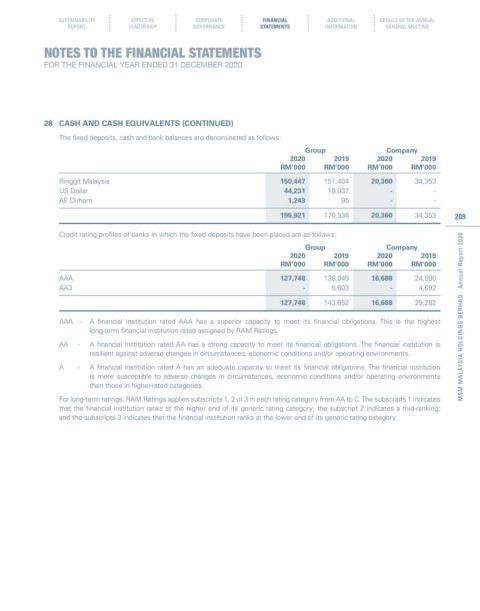

28 CASH AND CASH EQUIVALENTS (CONTINUED)

The fixed deposits, cash and bank balances are denominated as follows:

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Ringgit Malaysia 150,447 151,404 20,360 34,353

US Dollar 44,231 19,037 - -

AE Dirham 1,243 95 - -

195,921 170,536 20,360 34,353 209

Credit rating profiles of banks in which the fixed deposits have been placed are as follows:

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

AAA 127,748 138,049 16,688 24,590

AA3 - 5,603 - 4,692

127,748 143,652 16,688 29,282

AAA - A financial institution rated AAA has a superior capacity to meet its financial obligations. This is the highest MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

long-term financial institution rated assigned by RAM Ratings.

AA - A financial institution rated AA has a strong capacity to meet its financial obligations. The financial institution is

resilient against adverse changes in circumstances, economic conditions and/or operating environments.

A - A financial institution rated A has an adequate capacity to meet its financial obligations. The financial institution

is more susceptible to adverse changes in circumstances, economic conditions and/or operating environments

than those in higher-rated categories.

For long-term ratings, RAM Ratings applies subscripts 1, 2 or 3 in each rating category from AA to C. The subscripts 1 indicates

that the financial institution ranks at the higher end of its generic rating category; the subscript 2 indicates a mid-ranking;

and the subscripts 3 indicates that the financial institution ranks at the lower end of its generic rating category.