Page 213 - MSM_AR2020

P. 213

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

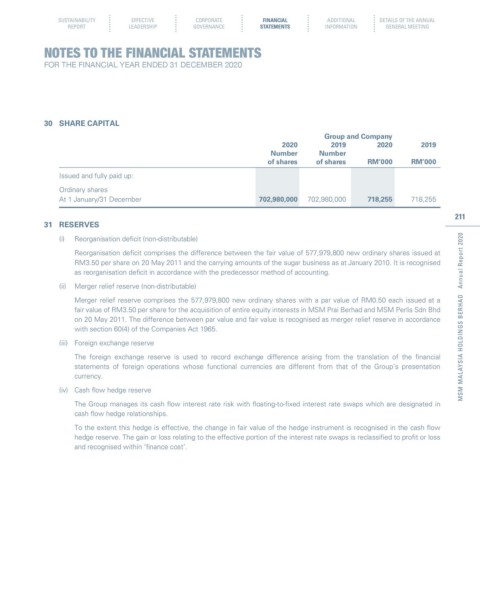

30 SHARE CAPITAL

Group and Company

2020 2019 2020 2019

Number Number

of shares of shares RM’000 RM’000

Issued and fully paid up:

Ordinary shares

At 1 January/31 December 702,980,000 702,980,000 718,255 718,255

211

31 RESERVES

(i) Reorganisation deficit (non-distributable)

Reorganisation deficit comprises the difference between the fair value of 577,979,800 new ordinary shares issued at

RM3.50 per share on 20 May 2011 and the carrying amounts of the sugar business as at January 2010. It is recognised

as reorganisation deficit in accordance with the predecessor method of accounting.

(ii) Merger relief reserve (non-distributable)

Merger relief reserve comprises the 577,979,800 new ordinary shares with a par value of RM0.50 each issued at a

fair value of RM3.50 per share for the acquisition of entire equity interests in MSM Prai Berhad and MSM Perlis Sdn Bhd

on 20 May 2011. The difference between par value and fair value is recognised as merger relief reserve in accordance MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

with section 60(4) of the Companies Act 1965.

(iii) Foreign exchange reserve

The foreign exchange reserve is used to record exchange difference arising from the translation of the financial

statements of foreign operations whose functional currencies are different from that of the Group’s presentation

currency.

(iv) Cash flow hedge reserve

The Group manages its cash flow interest rate risk with floating-to-fixed interest rate swaps which are designated in

cash flow hedge relationships.

To the extent this hedge is effective, the change in fair value of the hedge instrument is recognised in the cash flow

hedge reserve. The gain or loss relating to the effective portion of the interest rate swaps is reclassified to profit or loss

and recognised within ‘finance cost’.