Page 209 - MSM_AR2020

P. 209

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

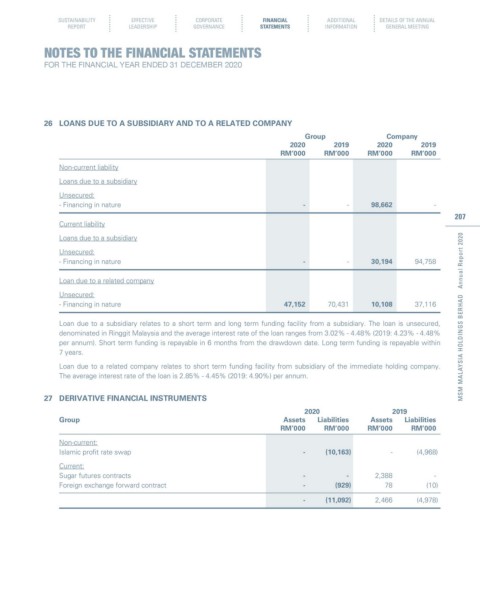

26 LOANS DUE TO A SUBSIDIARY AND TO A RELATED COMPANY

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Non-current liability

Loans due to a subsidiary

Unsecured:

- Financing in nature - - 98,662 -

207

Current liability

Loans due to a subsidiary

Unsecured:

- Financing in nature - - 30,194 94,758

Loan due to a related company

Unsecured:

- Financing in nature 47,152 70,431 10,108 37,116

Loan due to a subsidiary relates to a short term and long term funding facility from a subsidiary. The loan is unsecured, MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

denominated in Ringgit Malaysia and the average interest rate of the loan ranges from 3.02% - 4.48% (2019: 4.23% - 4.48%

per annum). Short term funding is repayable in 6 months from the drawdown date. Long term funding is repayable within

7 years.

Loan due to a related company relates to short term funding facility from subsidiary of the immediate holding company.

The average interest rate of the loan is 2.85% - 4.45% (2019: 4.90%) per annum.

27 DERIVATIVE FINANCIAL INSTRUMENTS

2020 2019

Group Assets Liabilities Assets Liabilities

RM’000 RM’000 RM’000 RM’000

Non-current:

Islamic profit rate swap - (10,163) - (4,968)

Current:

Sugar futures contracts - - 2,388 -

Foreign exchange forward contract - (929) 78 (10)

- (11,092) 2,466 (4,978)