Page 214 - MSM_AR2020

P. 214

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

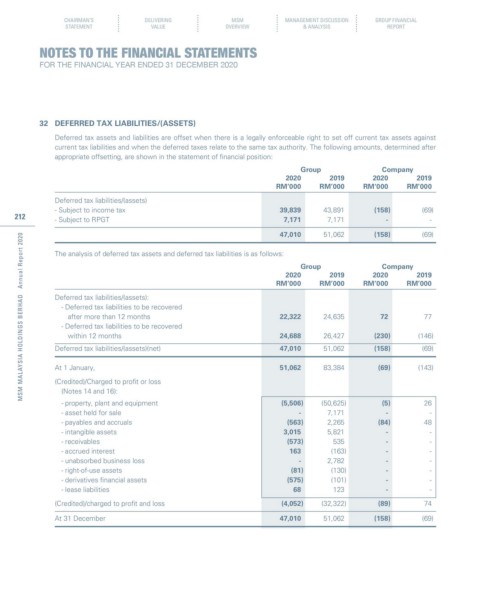

32 DEFERRED TAX LIABILITIES/(ASSETS)

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against

current tax liabilities and when the deferred taxes relate to the same tax authority. The following amounts, determined after

appropriate offsetting, are shown in the statement of financial position:

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Deferred tax liabilities/(assets)

- Subject to income tax 39,839 43,891 (158) (69)

212 - Subject to RPGT 7,171 7,171 - -

47,010 51,062 (158) (69)

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

The analysis of deferred tax assets and deferred tax liabilities is as follows:

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Deferred tax liabilities/(assets):

- Deferred tax liabilities to be recovered

after more than 12 months 22,322 24,635 72 77

- Deferred tax liabilities to be recovered

within 12 months 24,688 26,427 (230) (146)

Deferred tax liabilities/(assets)(net) 47,010 51,062 (158) (69)

At 1 January, 51,062 83,384 (69) (143)

(Credited)/Charged to profit or loss

(Notes 14 and 16):

- property, plant and equipment (5,506) (50,625) (5) 26

- asset held for sale - 7,171 - -

- payables and accruals (563) 2,265 (84) 48

- intangible assets 3,015 5,821 - -

- receivables (573) 535 - -

- accrued interest 163 (163) - -

- unabsorbed business loss - 2,782 - -

- right-of-use assets (81) (130) - -

- derivatives financial assets (575) (101) - -

- lease liabilities 68 123 - -

(Credited)/charged to profit and loss (4,052) (32,322) (89) 74

At 31 December 47,010 51,062 (158) (69)