Page 215 - MSM_AR2020

P. 215

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

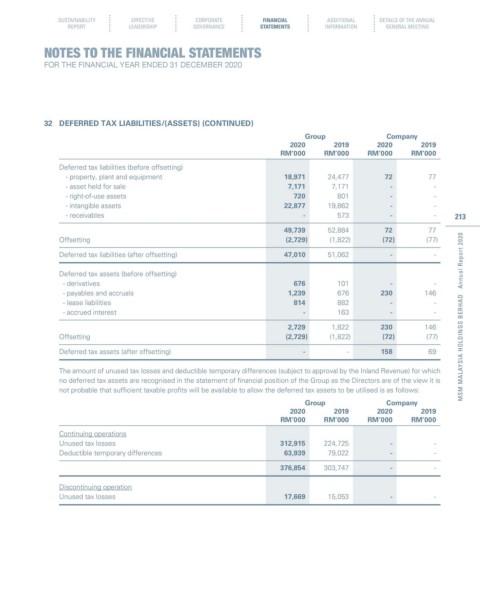

32 DEFERRED TAX LIABILITIES/(ASSETS) (CONTINUED)

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Deferred tax liabilities (before offsetting)

- property, plant and equipment 18,971 24,477 72 77

- asset held for sale 7,171 7,171 - -

- right-of-use assets 720 801 - -

- intangible assets 22,877 19,862 - -

- receivables - 573 - - 213

49,739 52,884 72 77

Offsetting (2,729) (1,822) (72) (77)

Deferred tax liabilities (after offsetting) 47,010 51,062 - -

Deferred tax assets (before offsetting)

- derivatives 676 101 - -

- payables and accruals 1,239 676 230 146

- lease liabilities 814 882 - -

- accrued interest - 163 - - MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

2,729 1,822 230 146

Offsetting (2,729) (1,822) (72) (77)

Deferred tax assets (after offsetting) - - 158 69

The amount of unused tax losses and deductible temporary differences (subject to approval by the Inland Revenue) for which

no deferred tax assets are recognised in the statement of financial position of the Group as the Directors are of the view it is

not probable that sufficient taxable profits will be available to allow the deferred tax assets to be utilised is as follows:

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Continuing operations

Unused tax losses 312,915 224,725 - -

Deductible temporary differences 63,939 79,022 - -

376,854 303,747 - -

Discontinuing operation

Unused tax losses 17,669 15,053 - -