Page 216 - MSM_AR2020

P. 216

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

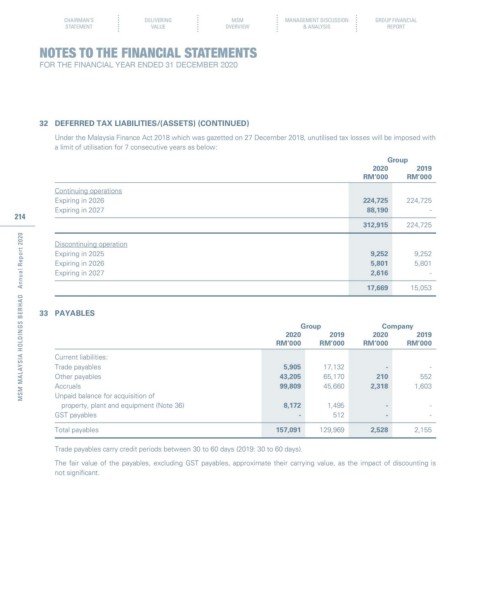

32 DEFERRED TAX LIABILITIES/(ASSETS) (CONTINUED)

Under the Malaysia Finance Act 2018 which was gazetted on 27 December 2018, unutilised tax losses will be imposed with

a limit of utilisation for 7 consecutive years as below:

Group

2020 2019

RM’000 RM’000

Continuing operations

Expiring in 2026 224,725 224,725

Expiring in 2027 88,190 -

214

312,915 224,725

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Discontinuing operation

Expiring in 2025 9,252 9,252

Expiring in 2026 5,801 5,801

Expiring in 2027 2,616 -

17,669 15,053

33 PAYABLES

Group Company

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Current liabilities:

Trade payables 5,905 17,132 - -

Other payables 43,205 65,170 210 552

Accruals 99,809 45,660 2,318 1,603

Unpaid balance for acquisition of

property, plant and equipment (Note 36) 8,172 1,495 - -

GST payables - 512 - -

Total payables 157,091 129,969 2,528 2,155

Trade payables carry credit periods between 30 to 60 days (2019: 30 to 60 days).

The fair value of the payables, excluding GST payables, approximate their carrying value, as the impact of discounting is

not significant.