Page 203 - MSM_AR2020

P. 203

SUSTAINABILITY EFFECTIVE CORPORATE FINANCIAL ADDITIONAL DETAILS OF THE ANNUAL

REPORT LEADERSHIP GOVERNANCE STATEMENTS INFORMATION GENERAL MEETING

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

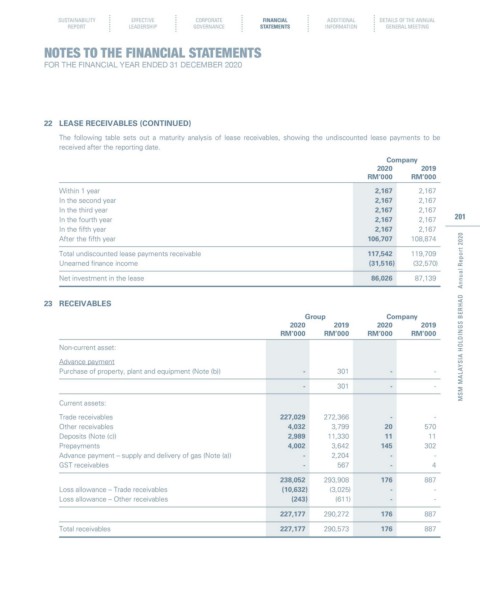

22 LEASE RECEIVABLES (CONTINUED)

The following table sets out a maturity analysis of lease receivables, showing the undiscounted lease payments to be

received after the reporting date.

Company

2020 2019

RM’000 RM’000

Within 1 year 2,167 2,167

In the second year 2,167 2,167

In the third year 2,167 2,167

In the fourth year 2,167 2,167 201

In the fifth year 2,167 2,167

After the fifth year 106,707 108,874

Total undiscounted lease payments receivable 117,542 119,709

Unearned finance income (31,516) (32,570)

Net investment in the lease 86,026 87,139

23 RECEIVABLES

Group Company MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Non-current asset:

Advance payment

Purchase of property, plant and equipment (Note (b)) - 301 - -

- 301 - -

Current assets:

Trade receivables 227,029 272,366 - -

Other receivables 4,032 3,799 20 570

Deposits (Note (c)) 2,989 11,330 11 11

Prepayments 4,002 3,642 145 302

Advance payment – supply and delivery of gas (Note (a)) - 2,204 - -

GST receivables - 567 - 4

238,052 293,908 176 887

Loss allowance – Trade receivables (10,632) (3,025) - -

Loss allowance – Other receivables (243) (611) - -

227,177 290,272 176 887

Total receivables 227,177 290,573 176 887