Page 198 - MSM_AR2020

P. 198

CHAIRMAN’S DELIVERING MSM MANAGEMENT DISCUSSION GROUP FINANCIAL

STATEMENT VALUE OVERVIEW & ANALYSIS REPORT

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020

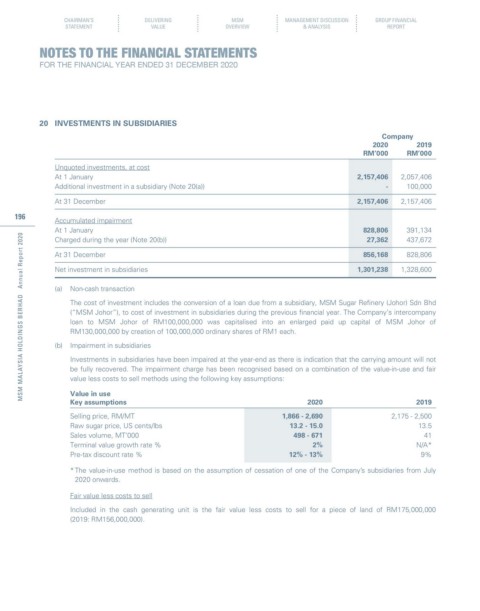

20 INVESTMENTS IN SUBSIDIARIES

Company

2020 2019

RM’000 RM’000

Unquoted investments, at cost

At 1 January 2,157,406 2,057,406

Additional investment in a subsidiary (Note 20(a)) - 100,000

At 31 December 2,157,406 2,157,406

196 Accumulated impairment

At 1 January 828,806 391,134

MSM MALAYSIA HOLDINGS BERHAD Annual Report 2020

Charged during the year (Note 20(b)) 27,362 437,672

At 31 December 856,168 828,806

Net investment in subsidiaries 1,301,238 1,328,600

(a) Non-cash transaction

The cost of investment includes the conversion of a loan due from a subsidiary, MSM Sugar Refinery (Johor) Sdn Bhd

(“MSM Johor”), to cost of investment in subsidiaries during the previous financial year. The Company’s intercompany

loan to MSM Johor of RM100,000,000 was capitalised into an enlarged paid up capital of MSM Johor of

RM130,000,000 by creation of 100,000,000 ordinary shares of RM1 each.

(b) Impairment in subsidiaries

Investments in subsidiaries have been impaired at the year-end as there is indication that the carrying amount will not

be fully recovered. The impairment charge has been recognised based on a combination of the value-in-use and fair

value less costs to sell methods using the following key assumptions:

Value in use

Key assumptions 2020 2019

Selling price, RM/MT 1,866 - 2,690 2,175 - 2,500

Raw sugar price, US cents/lbs 13.2 - 15.0 13.5

Sales volume, MT’000 498 - 671 41

Terminal value growth rate % 2% N/A*

Pre-tax discount rate % 12% - 13% 9%

* The value-in-use method is based on the assumption of cessation of one of the Company’s subsidiaries from July

2020 onwards.

Fair value less costs to sell

Included in the cash generating unit is the fair value less costs to sell for a piece of land of RM175,000,000

(2019: RM156,000,000).